The Golden Card Program (Trump Card)

Introduction to the Gold Card Program

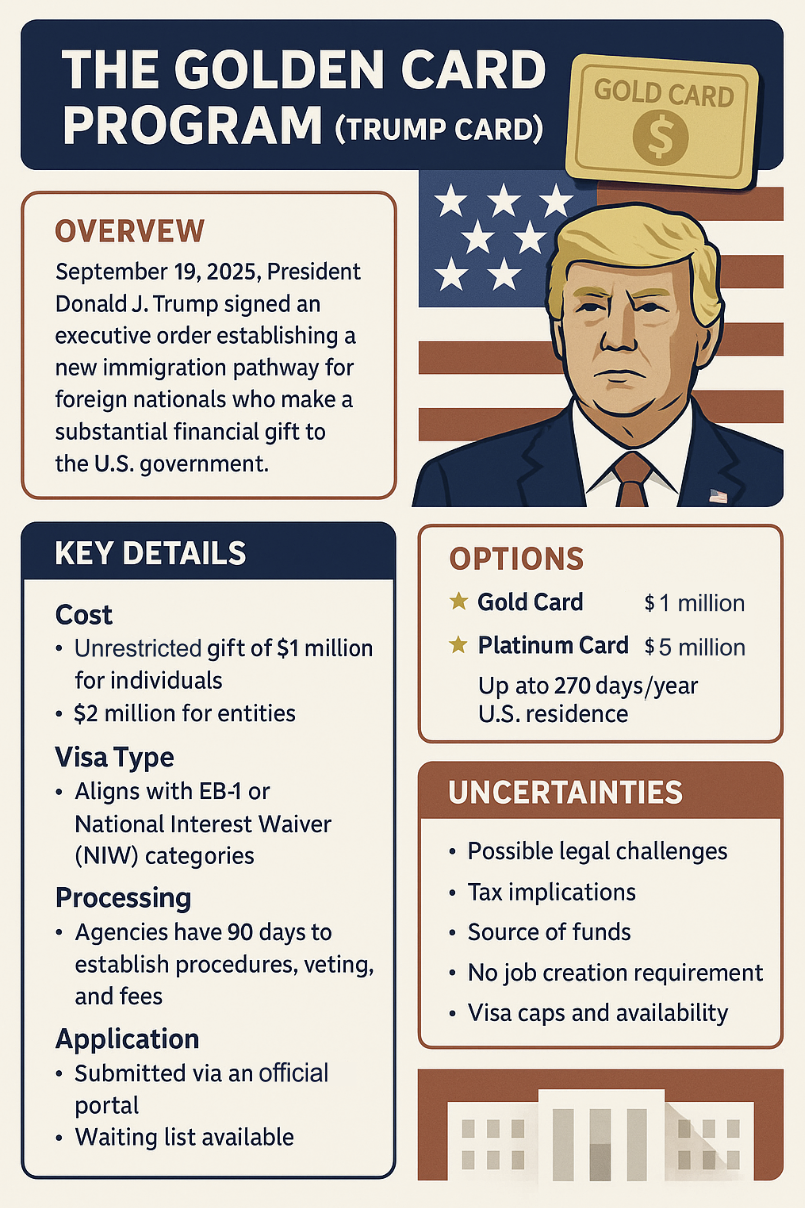

On September 19, 2025, President Donald J. Trump signed an Executive Order establishing the Gold Card program, also known as the Trump Card, a novel immigration pathway intended to provide foreign nationals an expedited immigrant visa in exchange for a substantial financial gift to the U.S. government. This program represents a new approach within the U.S. immigration framework, aiming to attract significant investment while offering a streamlined visa process.

Key Details of the Gold Card Program

- Cost / Gift Amount: Individual applicants must provide an unrestricted gift of US$1 million; corporations or entities must provide US$2 million. The definition of “unrestricted gift” and acceptable forms of payment will be clarified by implementing agencies.

- Visa Type / Status: The gift serves as evidence of eligibility under EB-1, Exceptional Business Ability/National Benefit, or National Interest Waiver (NIW), though how Gold Card status aligns with permanent residency timelines remains to be detailed.

- Processing & Vetting: Departments of Commerce, State, and Homeland Security have 90 days from September 19, 2025 to establish procedures, vetting, fees, and application processes, with standards and timelines not yet published.

- Platinum Card Option: Requires a US$5 million gift and allows up to 270 days/year residence in the U.S. without U.S. tax on non-U.S. income, though tax benefits and regulations are still pending IRS/Treasury guidance.

- Application Process: Applications are submitted through an official portal with waiting lists available for both Gold and Platinum Cards, though the impact of statutory visa caps, quotas, and backlog management remains uncertain.

What Remains Unclear / Risks & Legal Questions

- Statutory Authority & Legal Challenges: There may be legal scrutiny over whether the Executive Order exceeds statutory authority, particularly concerning visa quotas and the interplay with existing immigration law.

- Tax Implications: While the Platinum Card promises tax benefits, these are contingent on final IRS regulations. The Gold Card’s tax consequences for donors and recipients need further clarification.

- Source of Funds & Compliance: Applicants will be required to document the lawful source of funds thoroughly. The standards for acceptable evidence and anti-money laundering compliance are yet to be fully defined.

- Lack of Job Creation Requirement: Unlike traditional investor visas (e.g., EB-5), the Gold Card program does not explicitly require job creation, which may affect its reception and legal standing.

- Waiting List, Caps, and Availability: The program’s capacity, visa number availability, and how waiting lists will be managed have not been fully disclosed.

What This Means for Prospective Clients

The Gold Card program (Trump Card) supplements existing immigration pathways such as EB-1 (Extraordinary Ability), EB-2 National Interest Waiver (NIW), and EB-5 Investor Visa categories. For eligible applicants, the Trump Card may offer a faster or more straightforward route to permanent residency compared to traditional work visas, provided they meet the gift requirements and other admissibility criteria. However, applicants should be aware of ongoing legal and procedural developments that may affect eligibility and processing.

How Vinland Immigration Can Help

At Vinland Immigration, we offer comprehensive support tailored to the Gold Card (Trump Card) and Platinum Card programs:

- Eligibility Assessment: We evaluate your qualifications against the gift requirements, admissibility standards, and existing visa categories (EB-1, EB-2, NIW) to determine the best immigration strategy.

- Structuring the Gift / Donation: We provide guidance on how to structure your financial gift to meet legal definitions of “unrestricted,” including advice on individual vs. corporate donations and documentation.

- Preparing Documentation: Our team assists in gathering and organizing critical evidence such as business records, tax returns, source of funds documentation, and background information to support your application.

- Application & Filing Advice: We help you navigate the new application portal, ensure compliance with vetting procedures, and advise on timely and accurate filing.

- Tax & Residency Advisory: We coordinate with tax professionals to clarify potential tax implications of the Gold and Platinum Cards, including residency requirements and international tax planning.

- Monitoring Regulations & Policy Updates: Given the evolving nature of this program, we continuously track regulatory changes, policy announcements, and legal developments to keep your case current.

- Alternatives & Fallback Strategies: In case of delays, legal challenges, or statutory limits, we help explore other immigration options such as traditional investor visas, employment-based categories, or family-based immigration pathways.

Practical Steps to Take Now

- Contact us to schedule a consultation and receive personalized guidance on navigating the Gold Card (Trump Card) and Platinum Card programs effectively.

- Begin collecting financial documentation demonstrating your capacity to make the required gift, including bank statements, tax returns, and business records.

- Assemble evidence of lawful source of funds to meet anticipated compliance and anti-money laundering standards.

- Prepare admissibility-related documentation such as background checks, criminal record clearances, and security screenings.

- Consult with tax and legal advisors experienced in U.S. immigration and international taxation to understand potential impacts.